Cryptocurrency exchange Binance released its latest proof-of-reserves (PoR) on Aug. 1, offering transparency into its crypto reserves. However, the movement of its USDC reserves at the time of Silvergte's collapse caught many people’s attention and became a topic of discussion on X.

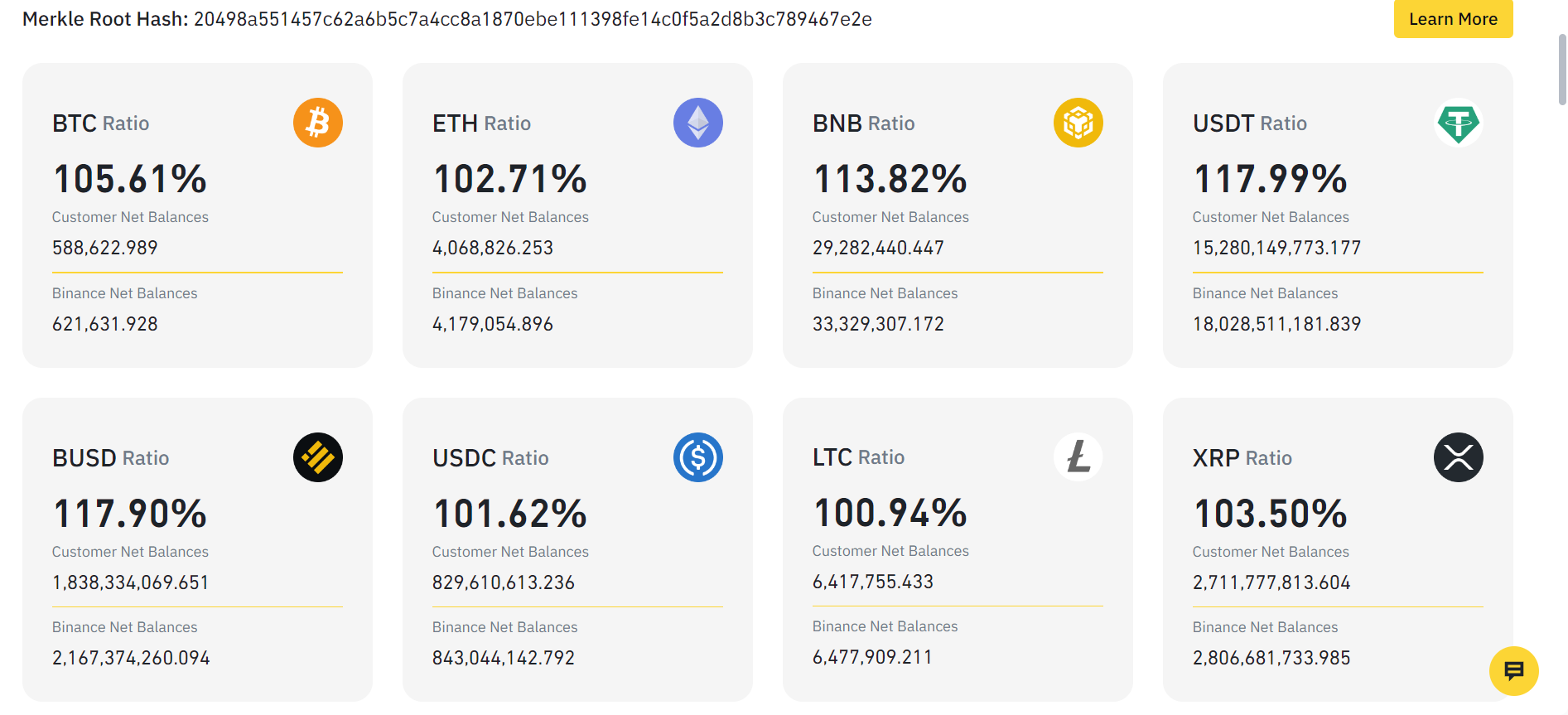

The latest reserve audit suggests Binance holds more than enough crypto and cash to cover the user funds. The ratio of Binance's net balances to its customers' net balances is more than 100% for all its assets as shown in the snapshot below.

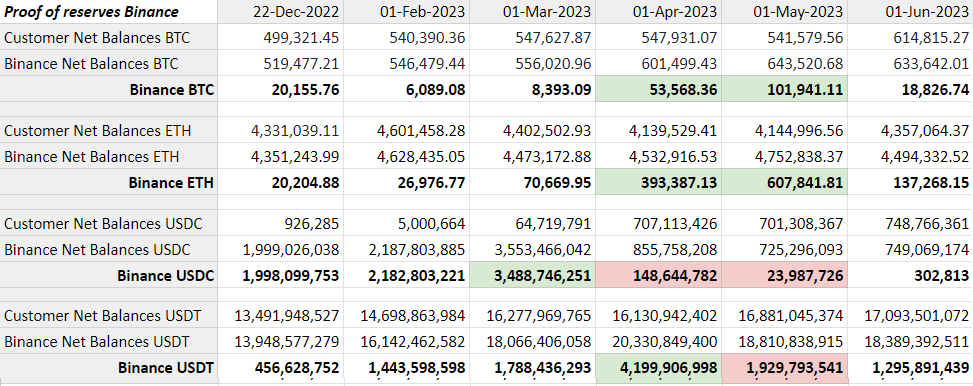

While the report presents a healthy financial situation for Binance, its USDC reserve movements post-Silvergate collapse and the depeg of the stablecoin was the main topic of discussion. The PoR shows that Binance’s USDC balance decreased from $3.4 billion on March 1st to $23.9 million by May 1st.

Binance started converting customer’s USDC to BUSD in September internally, but at the time it did hold a significant amount of USDC in its reserves as well. On-chain data suggests, right after Silvergate collapsed on March 12, Binance started converting its USDC reserves into Bitcoin and Ether Twitter on-chain analyst Aleksandar Djakovic noted that Binance purchased approximately 100,000 BTC and 550,000 ETH between March 12, - May 01, totalling around $3.5 billion, the same amount as the surplus of USDC they had.

Binance didn’t respond to Cointelegraph’s requests for comments at the time of writing.

The revelation around Binance’s USDC reserves has become a hot topic, especially after Coinbase CEO Brian Armstrong quipped during the company Q2 earnings call meeting that Binance has sold USDC for another stablecoin.

PoR became a popular way for crypto exchanges to attest their holdings and share the same with the public as a way of transparency after the collapse of the FTX crypto exchange. The calls for more transparency grew in the crypto ecosystem after FTX became crippled despite founders claiming its financial situation was well-balanced until its collapse in November 2022.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Previous article

Copyright © 2021-2024 AssessCrypto All rights reserved.