Many investors are uneasy since Bitcoin value has fallen by around 70% since its peak in November 2021. In the meantime, market sentiment is at an all-time low due to analysts’ expectations of a major recession. This is especially clear from the decline in the equity markets as measured by the S&P 500 and Nasdaq 100 indices, which has a big impact on how people invest in BTC on regulated markets.

When taking a look at the Grayscale Bitcoin Trust, the share price has significantly decreased from its peak of roughly $56 to $11.94. At the same time, the share values of 3iQ CoinShares Bitcoin ETF and Purpose Bitcoin Canadian ETF both fell sharply.

The Grayscale Bitcoin Trust (GBTC) has fallen deeply to $11.94 since its peak. Source: TradingView

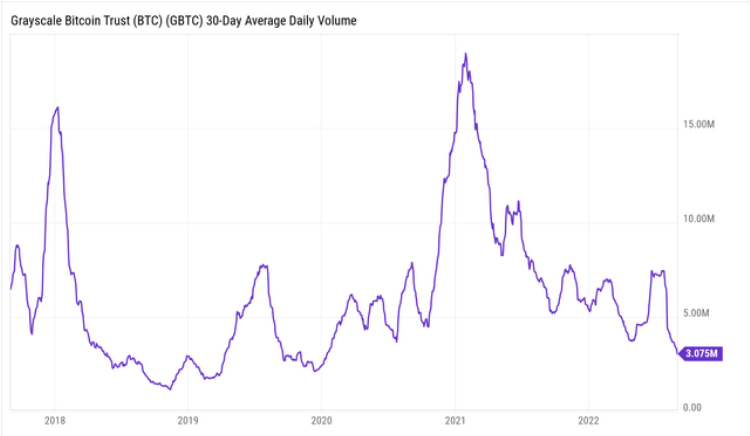

Despite the shares’ significant discount, GBTC’s daily trading volume has drastically decreased to 3.075M. It suggests that institutional investors might be skeptical about Bitcoin-related financial products on the regulated market or they might just believe that the bear market is not yet over.

The daily trading volume of GBTC has sharply dropped to 3.075M despite the generous discount of the shares. Source: YCharts

Additionally, given the current market conditions, certain trusts and ETFs are gradually selling off their holdings. For instance, since reaching its high in February 2022, the total amount of BTC held by the Grayscale Bitcoin Trust has decreased.Moreover, since the market peaked in May 2021, the total number of Bitcoins held by various trusts and ETFs has sharply decreased.

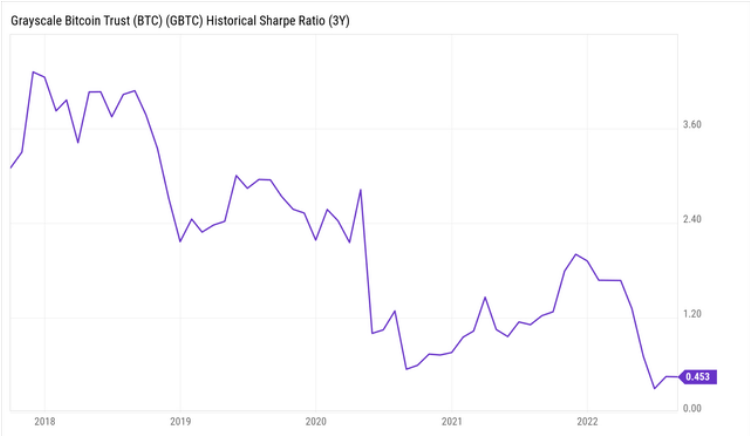

The Sharpe ratio indicates that GBTC is a bad asset with a very low risk-adjusted performance in terms of return on investment. In fact, the Sharpe ratio has recently dropped to 0.453 after declining over time. It implies that while GBTC’s volatility is fairly high, the projected return on investment is rather modest.

The current pioneer crypto investment vehicles in regulated markets, including trusts and ETFs, have to some extent displayed the pessimistic signal. Despite the significant discount at which GBTC has been sold, the daily trading volume is steadily declining, and several trusts and ETFs, such as Grayscale Bitcoin Trust, have been urged to sell their BTC holdings.

The total number of BTC held by trusts & ETFs has plummeted since May 2021. Source: CryptoQuant

The current Bitcoin investment tools in regulated markets such as trusts and ETFs have shown the bearish signal to a certain extent. Although GBTC has been traded at a substantial loss, the daily trading volume keeps decreasing and some trusts and ETFs including Grayscale Bitcoin Trust have been encouraged to divest their Bitcoin holdings.

Sharpe ratio tells us that GBTC is a poor asset with a very low risk-adjusted performance. Source: YCharts

Because the shares of GBTC sold or bought by institutional investors are reported quarterly, many recent trades may have not been listed yet. However, these above figures could give us some clues of what may be actually happening with Bitcoin behind the scenes.

Retailers can only be aware that a local bottom has been reached after it has already occurred, like in the case of institutional investors who purchased GBTC in late June just prior to the July rise.

Most notably, the Sharpe ratio shows that GBTC’s return on investment is rather low and that this asset appears to be quite risky. Therefore, at this time, investors would be ready to begin hedging against the rising negative downside risk of bitcoin.

Previous article

Copyright © 2021-2024 AssessCrypto All rights reserved.